All time high for bitcoins? Yes, you read it right. However, before you imagine the meteor explosion of your price, be aware that there is no record in this dimension. In fact, Bitcoin crossed the historical threshold in an area that is rarely addressed: its “realized capitalization”. An indicator that, although it seems less sexy than the price of bitcoins, could announce a large trend for digital assets.

In short

- Bitcoin reaches a new record in realized capitalization.

- Current stagnation masks probable bull pressure.

- The accumulation of investors remains solid and continuous.

- Increasing towards $ 100,000 seems to be immediate.

Realized capitalization: New Bull Indicator

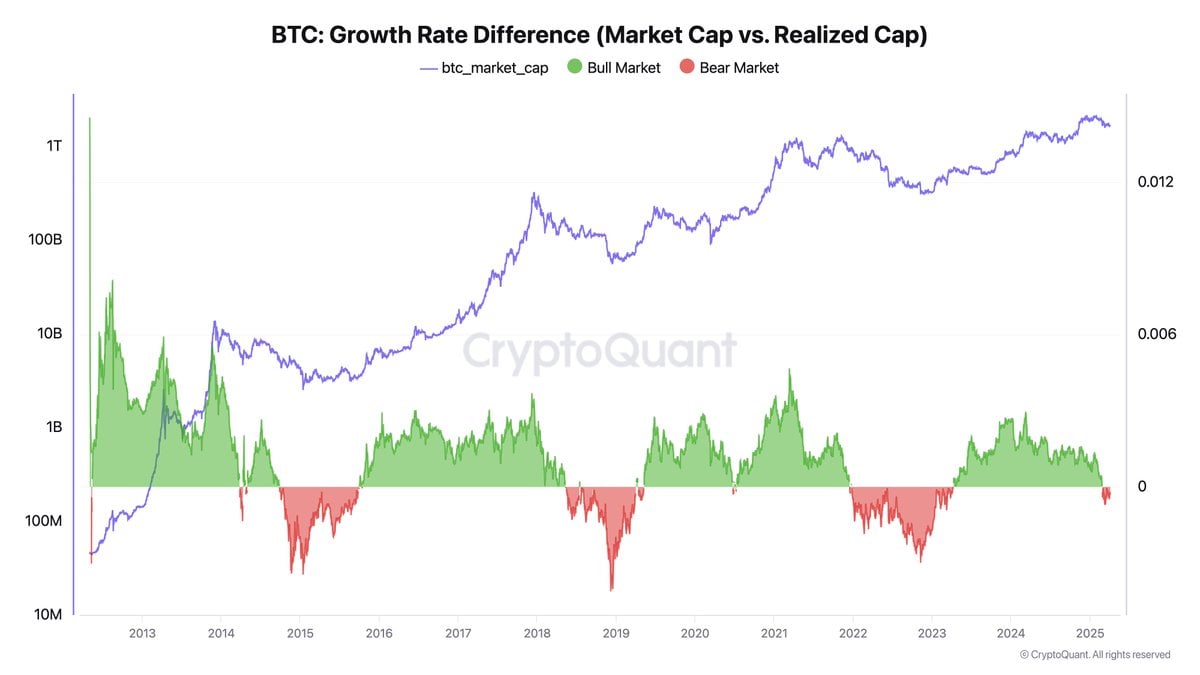

Realized Bitcoin capitalization has recently reached A record level of $ 882.2 billiondefeated his previous time high. But what does this indicator really mean? Unlike market capitalization, which is based on the current BTC price multiplied by the total offer, The realized capitalization takes into account the value of each bitcoin depending on the price to which it was last converted. This better reflects the actual investment in assets.

The fact that this metric reaches heights is Proof of investors’ trust towards bitcoins. According to the cryptocurrency, the analytical platform that recorded this ATH was such a historical accumulation of the realized cap was historically historically followed by a bull rally.

In other words, if investors continue to accumulate without selling, Bitcoin take -off prices could be immediate. It is interesting to note that this data does not take into account lost or left years, which strengthens the validity of this accumulation.

Cryptoier summarizes this very well:

Historically, after the great accumulation of realized capitalization, it was often followed by a significant increase in the price of bitcoins.

This emphasizes the importance of this indicator as a precursor signal of the future increase, although the market remains relatively calm for the time being.

Price stagnation: Simple level before another bull wave?

It is clear that BitcoinAlthough in the stagnation phase remains positive dynamics. Its price varies between $ 92,000 and $ 95,000, but this stability could be the key to its future output. These side movements are by far a sign of weakness, they are often an overture to a new ascending move.

The history of bitcoins really shows thisAfter each phase of consolidation the price often recorded a clear increase. This accumulation in times of peace is therefore perceived as a moment of waiting before the prices explosion.

Volumes of investment and Realized capitalization Continue growth, which could very well point out the preparation of a new ascending wave. A few days ago the cryptomera watched:

The realized cap continues to increase while prices stagnate. This shows capital entry without still price, which is typical before the new climb.

This BTC’s accumulation of BTC investors therefore strengthens the likelihood ofResistance of $ 100,000 or early. It is therefore legitimate to think that a turning point in this price area could open the way to a much larger bull market.

Current situation: trust, accumulation and perspective

In spite of the stagnation of the price Trust in bitcoins remains tangible. Investors are more involved than ever, and this long -term access to accumulation shows increased market stability. Bitcoin continues captivate small and large investors, This strengthens the perception that it is now a refuge against the traditional volatility of financial markets.

Effect Caps It can also be explained by the growing confidence of institutional actors and individuals in the cryptocurrency, which is increasingly considered to be a refuge. Citation Cryptoquant strengthens this analysis:

The market capital is proof that investors believe in a solid future for bitcoins.

Many investors are looking forward to further growth, convinced that current signals are an excellent sign for the future of bitcoins.

Although Bitcoin is currently stagnating, ATH in realized capitalization is a strong signal. This massive capital accumulation seems to be preparing the soil for a future increase. In addition, according to Chartered Standard, very optimistic prediction will place the price of Bitcoins for $ 200,000 per 2025. With such a solid investment base and this symbolic record is unified so that Bitcoin reaches new heights in the coming months.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Blockchain and crypto revolution! And the day when the impacts will be felt on the most vulnerable economy of this world, I would say against all the promises that I was there for something

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.