From the epic Michael Saylor, Microsthega and his Bitcoin mountains, the idea of ”bitcoin in strategic reserve” created an oil stain. The United States was pioneers. Asia with a metaplanet in Japan followed quickly. Europe, so far the viewer, has just taken an unexpected position in the Blockchain Group (TBG). This year 1 May 2025 introduced the Titanical ambition: by 2033 it accumulates 260,000 bitcoins. And perhaps the shock of influence.

In short

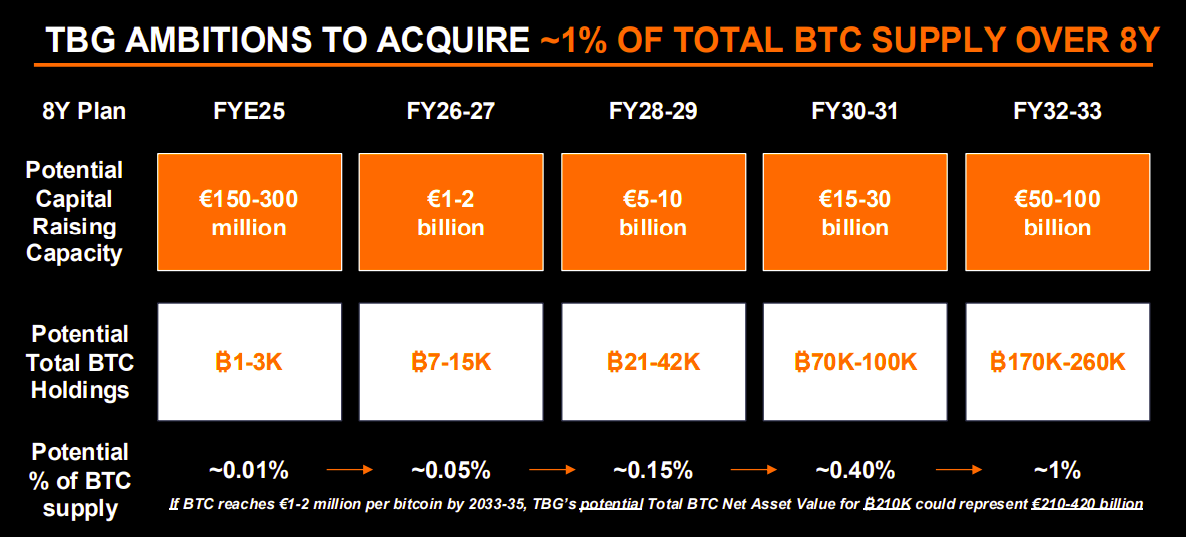

- The Blockchain Group focuses on 1 % of the total bitcoins offer by 2033.

- The Company funds this plan through events, debts, cash flows and strategic acquisitions.

- CEO Alexandre Laizet considers Bitcoin to be “the only trusted strategic reserve”.

A long -term strategy that makes noise

Bitcoin News: The Blockchain group was not satisfied with the gloss. Its plan is methodicalencrypted, spread over ten years. Objective: 1 % of the total Bitcoins offer. ” If Bitcoin reaches 1 to 2 million euros, it would represent 210,000 BTC between 210 and 420 billion euros net value “It determines the annual TBG report. A courageous hypothesis, but unrealistic according to its leaders.

To finance this plan, TBG provides Smart mixture : Share emissions through dynamic orders, bonds transferred to bitcoins, operating cash flow from its trading platforms and even merger and acquisitions focused on society already rich in bitcoins.

This Hybrid He recalls Microstratega, but with European touch. Society relies on ” Quick accumulation for as many accreditation as possible ». In other words, buy too quickly to dilute or risk the effect of extreme levers.

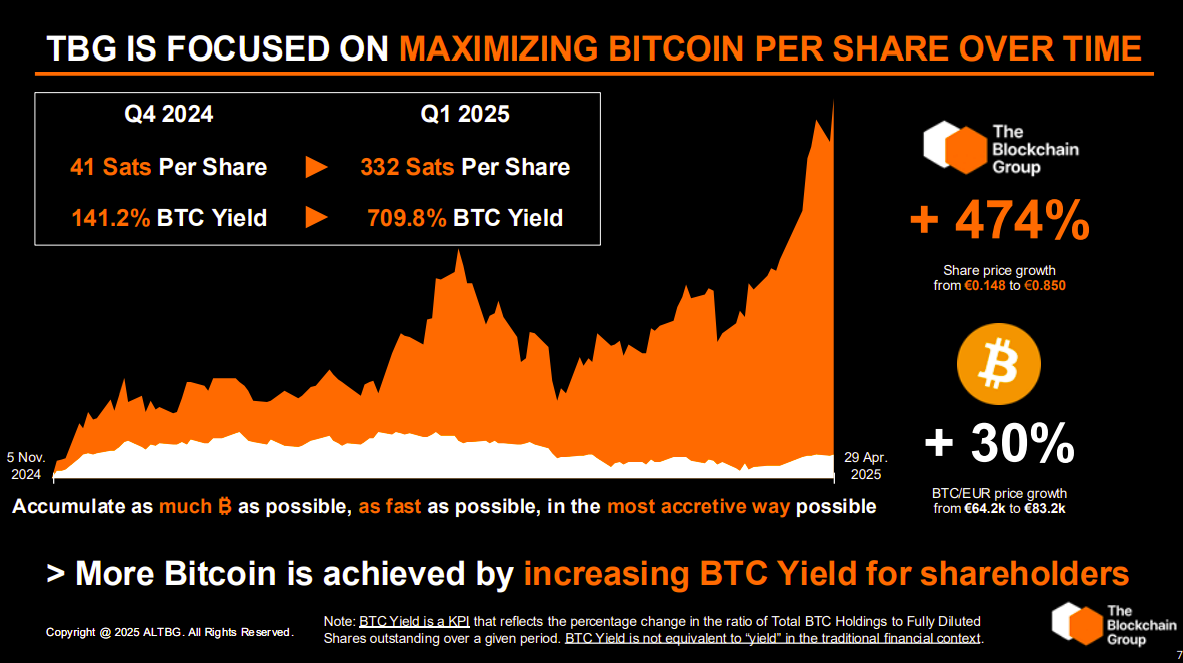

Already List to Growth Euronext Paris (Altbg)TBG saw his course flew 474 % in six months. This movement is supported by cryptocurrency investors such as Fulgur Ventures, UTXO management and Tobam. And according to the respected name: Adam back, strategist TBG.

Bitcoin: Expected geopolitical beliefs

Why does this strategic turn towards Bitcoin? The answer is caused Four words : Rarity, safety, inflation, independence.

Alexandre Laizet CEO summarizes this as follows:

There is no alternative. Bitcoin today is the only credible strategic reserve in the face of depreciation of trust.

He continues his message:

There is no plan B. There are only 21 million bitcoins and we want to capture 1 %.

This speech resonates at a time when Central banks hesitateWhere the currencies weaken and where the euro does not trust. TBG no longer wants to depend on the assets denominated in Fiat. He wants world property, inviolable, audited by code, not banks.

The 2024 half It has already reduced the emissions to 3.125 BTC to the block. By 2033 there is much to be undermined. The purchase now has to bet on the contraction of the menu and the FOMO effect. For the Laizet it is also a way to separate from ‘ A financial system based on unwavering promises ».

Europe will finally enter the Bitcoins race

The TBG initiative was part of the ecosystem. Yet, Europe shone with its strategic inertia. Too regulated, not bold. From now on, it is a European society that claims to want to become ” First Bitcoins holder in Europe ».

And it works. ” Bitcoin cash companies are the fastest growth in EuropeE, ”says TBG in his report. Their internal indicator, ‘BTC yield’ (bitcoins diluted action) increased by 709 % In the first quarter of 2025. This ratio is their North Star: the more it rises, the more shareholders find their account.

But it’s not just a financial bet. It is an industrial posture. Vision for ten years. A break with strategic softness of many European societies.

Some analysts were surprised: Why is Europe not responding to a wave of bitcoin reserves? Now he has a champion. The Blockchain Group sends a strong message: Europe can also dream of large, Bitcoin accumulation methodically and why not, lead the race.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Blockchain and crypto revolution! And the day when the impacts will be felt on the most vulnerable economy of this world, I would say against all hope that I was there for something

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.